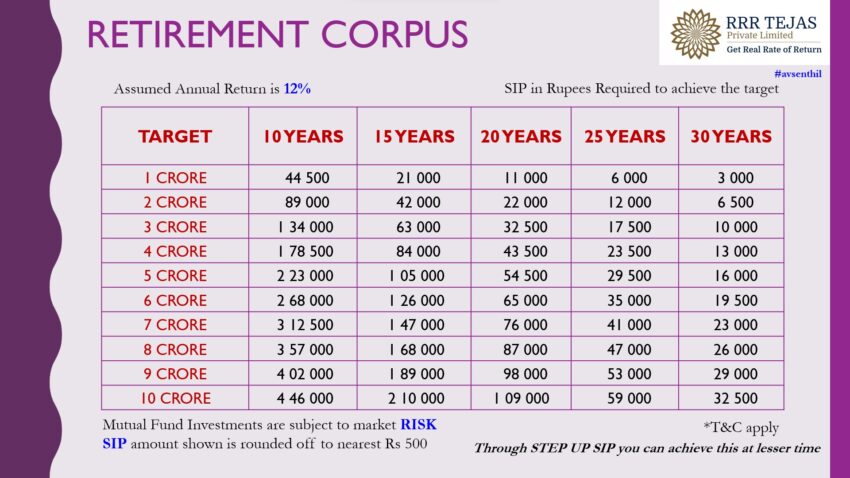

Retirement Corpus

Whenever I meet IT Professionals, most of them say, that their Financial Planner used MS EXCEL and told that the “Retirement Corpus” required is upwards of Rs. 5 Crores, considering their current lifestyle. Is it possible to achieve? and Is this corpus amount right?

The answer is “Yes” for first question. Corpus amount is achievable, provided you have TIME (Ex: say you are 28 years young and retirement age is 60 years (exclude HCL Technologies, where retirement is 55 years)) – Just by investing (not saving) Rs. 16,000 per month (as per the attached document) in right funds, you can achieve 5 Crores or more. Now next thought is whether 12% CAGR (Compounded Annual Growth Rate) is achievable? If you look at India’s nominal GDP rate – it is upwards of 10%. So through patience, we should be able to achieve this.

With respect to second question – Is the corpus amount right? the answer is, “It depends” upon your “current life style, current mandatory expenses and wish list”. It can either go up or go down, depending upon number of dependents, health insurance costs, vacation plans (domestic and international), legacy that you want to leave behind etc!

Will there be speed breakers during the 30 year journey? The answer is Yes!! Investor Behavior plays a vital role. What we have noticed is Investor Return is much lesser than Investment Return, because Investors redeem their investments, either when the markets are high (like now) or when markets are low (like Covid times)!!

Happy to be of help!!

LinkedIn Post Link – https://bit.ly/r3corpus

#avsenthil #rrrtejas #wealth #retirement #personalfinance #sip #tcs #hcl #wipro #infosys #investment #mutualfunds #rcubeprosperity #wealthcreation #financialfreedom #financialliteracy #wealthplanning #assetallocation #wealthmanagement