Women and Money Management

This year we had both ups and downs in our lives, due to the pandemic. Our finances were impacted in more than one way – job losses, salary cuts, no increments and no festive bonuses. In this article, we will discuss about five ways on how women can manage similar situations effectively in future.

But before that, Women are naturally gifted with

a) Discipline – Both at home or at work. They get up early, do the work diligently and balance most aspects of life.

b) Handling Crisis – Ex: When there is not enough food at kitchen, they bring out the creativity and manage situations

c) Communication – They reach out to people when needed.

Many women think money management is very difficult, as it involves maths, complex calculations, different products etc. In reality money management can be very easy if one can adopt the following five principles

1. Save first, before spending. Once the money is credited to the bank account, suggest saving at least 20% of the amount received. You should start investing from your first salary (Early 20’s)

2. Do a budget on a monthly basis for the remaining 80%. Put money in 6 or 7 envelopes – Example –

a. Family Needs – Vegetables, Grocery, utilities, mobile, DTH, Transportation, Maid, Driver etc

b. Kid’s Education, Tuition, Self-Development

c. Parents medicines,

d. Unknown expenses – Repairs

e. Entertainment

f. Donations / Charities and

g. All others – EMIs, SPA, Gym, Pets

3. At the end of the month do a quick reconciliation / introspection on budget vs. actuals. Cut down unnecessary expenses. Delayed Gratification does wonders.

4. Invest 2% to 5% of your salary to upgrade yourself to stay relevant in your employment – Get certifications, learn technology, upgrading gadgets

5. Save the 20% prudently and aim for returns which is 2% or 3% above inflation. Never invest in products which you don’t understand (or) which promises huge returns. High returns mean high risk!!!

Next obvious question is what should I do with the 20%?. Where should I invest?

1. Create an emergency fund which is equivalent of 3 to 6-month expenses. So, during pandemic time, even if there is a job loss, you can manage well. Best is to invest in a Bank Fixed Deposit (or) Liquid Mutual Funds.

2. Buy a Term Insurance for the bread winner. For a 30-year-old non-smoker it should cost Rs. 25 per day for 50 Lakh cover.

3. Government has come up with good long-term savings schemes like Public Provident Fund, Suganya Samriddhi Scheme, National Pension Scheme etc. If your employer has Voluntary Provident Fund, you can invest there. Lending money to Government at interest rate above inflation rate is the best way to protect the value of money.

4. After doing all the above if you are left with money, you can invest in Index Mutual Funds – Especially Nifty ETF or Sensex ETF

5. A small portion of the money can be invested in Gold – Say 5% of the 20% through Gold ETFs or Sovereign Gold Bonds, which gives 2.5% annual interest.

After doing the above if you have lots of money to invest, then suggest meeting a Certified Financial Planner to do a financial portfolio health check-up and invest in right products, based on your risk profile, market opportunities.

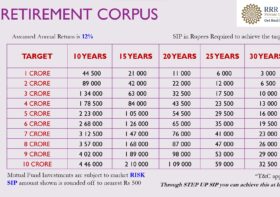

Investing on a monthly basis, periodical reviews, aligning investment to goals, will help you to achieve financial freedom by mid-40’s (or) early 50’s through power of compounding.

Top 8 mistakes done by many family households

1) Borrowing money and living lavishly. Example paying only the minimum amount due in the Credit card (or) taking personal loans.

2) Keep buying gadgets (or) unnecessary things especially during festive times like Diwali or Online Sale promotions

3) Thinking that expensive education for children is great education – In few countries, Public schools deliver better results than private schools

4) Buying endowment, pension, ULIP policies from Insurance Companies. Most endowment policies give around 5% returns.

5) Investing in products due to the pressure or influence of bank relationship managers (or) relatives (or) friends

6) Keeping the money in Saving Bank account (or) Bank Fixed Deposits

7) Buying apartments for rental income (or) investing in plots

8) Not buying term insurance at right time (Ex: after marriage (or) children’s birth (or) after taking home loan) and health insurance

Women bring smiles at home. They help the family members in two key aspects – Health and Relationships. By adopting the above five principles they can bring smile on the third aspect – Wealth – Achieve financial freedom by mid-40’s!

Happy Earning, Happy Saving, Happy Spending, Happy Investing and Happy Life, going forward. For questions you can reach us through WhatsApp or Email.

WhatsApp : 98416 71678

Email : cgo@avsenthil.com