Employees of Jet Airways

Got a forward in WhatsApp and thought of sharing it with you in this blog, by making few changes. Worth reading.

20000+ employees lost their job due to shutdown of Jet Airways.

Impact:

1. Many Employees would have Equated Monthly Instalments (EMIs) Running for Personal Loans, Home Loans, Vehicle Loans and so on.

2. Few might be struggling to make ends meets. And they may have to join whatever job they get, even with low salary and at a lower level / role.

3. Few women employees or Spouse of men employees might be Pregnant and may be terrified with this. And they have to find the next job, quickly.

4. Many wouldn’t have enough savings to survive till they find the new Job. For example, no emergency funds (or) adequate liquidity.

5. Many people might have planned so many things for their (bright) future or life style. Example: Expensive education for their children. World tour etc. Being in Airlines Industry, their life style expenses would be more.

But you know what? One such incident and you are nowhere!

You literally feel ____!!

Learning’s:

1. Never ever depend on single source of Income (Ex: Salary), Or I would say never ever depend on just 1 thing in Life. Have Multiple Sources of Income (Ex: Interest income, dividend income). For example, Pilots should have invested part of their savings in Rental yielding assets (Commercial properties or residential properties)

2. Always work towards Building Yourself (capabilities and competencies). Invest money in Making Yourself Irreplaceable (Make yourself such that it’s difficult to replace you with 1:1 replacement – Add immense value to the organisation you work for)

3. Do not feel secure at job ….. Always strive for the best.. What next, what else, what more? you could do

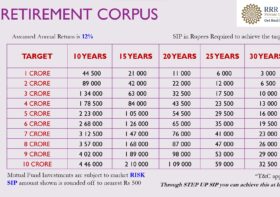

4. Build 6 months expenses as Emergency corpus in a liquid fund

5. Revisit your life style

6. Let your first expense be Savings

Financial Prudence helps!

We are in the first month of this Financial Year (FY 2019-20), suggest looking at (y)our cash inflows, outflows, incomes, expenses, assets, liabilities, goals etc. If you would like to have a 30 minute consultation (free), do reach out to us.