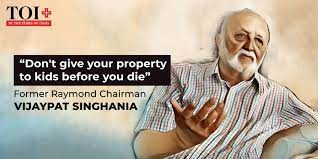

Vijaypat Singhania – Our Key Learnings

Welcome back!!

Before we share our takeaways, learnings, here is a brief about Vijaypat Singhania:

Vijaypat Singhania (born 1939) is an Indian industrialist and former chairman of Raymond Group, a leading Indian textile and clothing company. He took over the reins of the company from his father and under his leadership, Raymond Group diversified into multiple businesses including aviation, real estate, and FMCG.

He is credited with transforming Raymond Group into a global conglomerate with a presence in over 50 countries. Singhania is also a qualified pilot and has set several world records in aviation. As of 2021, his net worth was estimated to be over $1 billion USD (Approx INR 8,200 Crores).

However, there have been disputes with his son over property rights and inheritance.

Our Personal Takeaways:

1) Our longevity has increased to 90+, thanks to advancement in Medicine, Science, Technology – This implies we need to have a wealth distribution plan in place

2) Cost of living, especially geriatric care costs can be upwards of USD 500 per month in Chennai (Approx INR 41,000 as of May 2023) – Not a good idea to give all the wealth at one go – At the same time we can’t hold on to all our wealth!!

3) We need to distribute our earnings, legacy to our next generation (Children) at appropriate times – For their education, career, building businesses, marriage, asset purchase, key events (wedding anniversaries, birthdays etc)

4) Structuring of cash flows including Gift distribution, considering taxation aspects (Will, Testamentary Will, Trust) will help you to leave a legacy, protecting your interest and your spouse interests!

We have summarized the learnings in a two minute video – and here is the link – https://bit.ly/r3Raymond

Our Key Learnings:

1) Adopt the principle of “Live and Let Live” when managing finances

2) Take care of oneself and spouse first before distributing “hard earned savings” to next generation

3) Vijaypat Singhania’s story is a cautionary tale about giving away all wealth too quickly – The right time to start writing a “Will” is when you acquire your first asset. Keep reviewing the “Will” once a year!!

One of his famous quote “Don’t give your property to kids before you die.”

Happy Earning, Saving, Investing, Returning Back!!

Image courtesy: India Today, Times of India