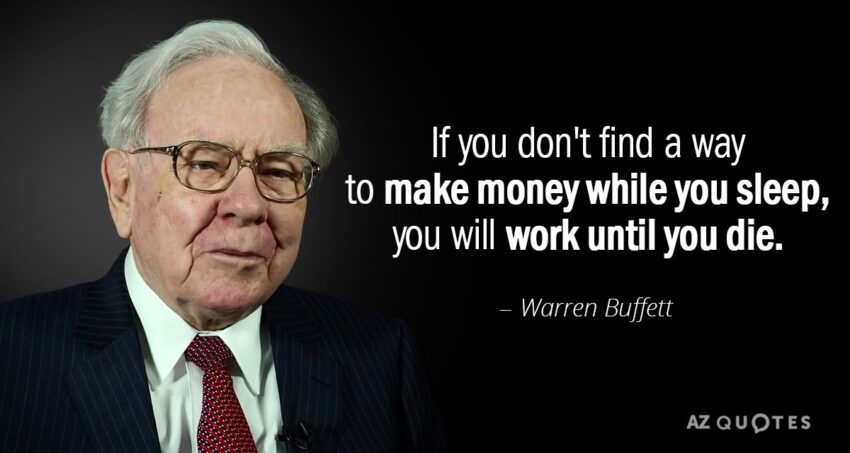

Warren Buffett – Our Key Learnings

Welcome to our blog!

Before we share our key takeaways, learnings, here is a brief about Warren Buffett.

Warren Buffett is a legendary American investor and one of the richest people (Investor) in the world. Born in 1930 in Nebraska, Buffett developed an early interest in investing and became a millionaire by the age of 32. He is the CEO and chairman of Berkshire Hathaway, a multinational conglomerate holding company. Buffett is known for his long-term value investing approach, which has earned him billions of dollars (Upwards of $90 Billion, ~INR 7.38 Lakh Crores) over the years. He is also a philanthropist, having pledged to give away 99% of his wealth to charitable causes. Buffett is widely regarded as one of the most successful investors of all time and a role model for aspiring investors.

Our Personal Takeaways:

1) Started investing at an early age (~12 years)

2) Made best use of “Power of compounding”

3) He made 99% of his wealth after he turned 53 years

4) Still active in Equity Markets at the Age of 93

We have summarized the learnings in a two minute video – and here is the link, https://bit.ly/r3warren

Key Learnings:

1) Patience – Time in the market is more Important than TIMING

2) No day trading, no short cut to investing, buy Businesses (not stocks)

3) Focus on long term

To end, here is a powerful quote from the legendary investor – “Be Greedy, when other are Fearful. Be Fearful, when others are Greedy!’

If you like the video, do subscribe to the channel and also share the link with your friends and families!! Happy Investing!!

Image courtesy: NORM BETTS, AZ QUOTES