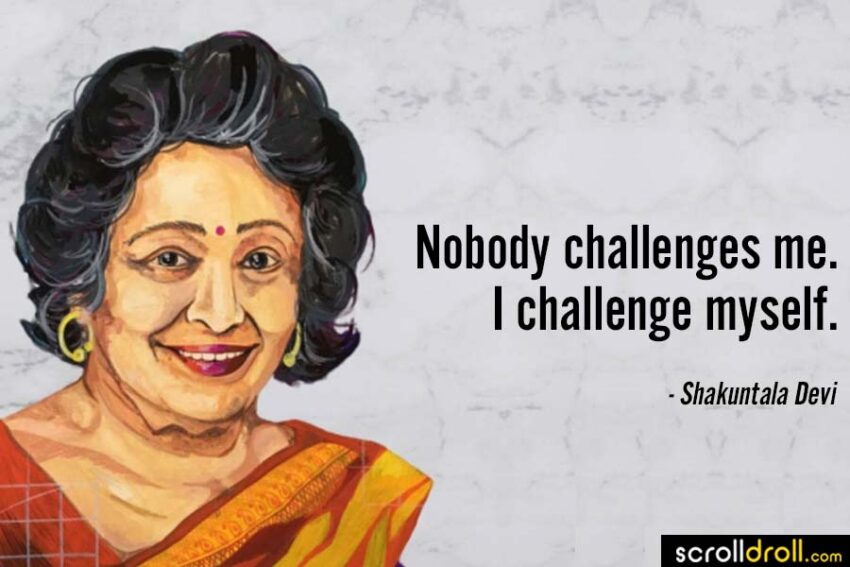

Shakuntala Devi – Our Key Learnings

One of the famous Math Wizard during this century!

Before we share our takeaways, learnings, here is the brief about Shakuntala Devi

Shakuntala Devi was an Indian mathematician, writer, and mental calculator known as the “Human Computer.” Born in 1929 in Bangalore, she demonstrated remarkable mathematical abilities from a young age and gained fame for her ability to perform complex mental calculations quickly and accurately. She travelled the world demonstrating her skills and authored several books on mathematics and astrology. Devi was also an advocate for the rights of LGBTQ+ individuals in India. She passed away in 2013 at the age of 83.

We urge you to watch her movie in Amazon Prime Video!!

Our Personal Takeaways:

- Shakuntala Devi, made a significant amount of money (Several Crores of Rupees)

- However, she faced challenges when it came to the “distribution” of her wealth

- It could have been done through Trust during her lifetime, instead of using “Registered Will”, which was contested!!

- Each one of us should prepare a “Will”, especially when we acquire physical assets like Property

We have summarized the learnings in a two minute video – and here is the link – https://bit.ly/r3sdevi

- While making money is important, other aspects like family relationships are much more important

- It’s essential to nurture family relationships to create a positive and supportive environment that enables growth and happiness for all family members.

- Helping family members grow can have long-lasting benefits and can contribute to a sense of belonging and togetherness.

- Thus, health, wealth and relationships should be a key priority for each one of us, for a fulfilling and meaningful life.

End Note:

One option for transitioning wealth is through a trust, which is a legal arrangement where assets are managed by a trustee for the benefit of one or more beneficiaries.

There are two types of trusts: Public trust and Private trust. Public trusts are established for charitable purposes and benefit the public, while private trusts are created for specific individuals or entities. Both types of trusts can be effective in managing wealth and ensuring its distribution according to the wishes of the settlor.

Trusts can also be classified as Discretionary Trust and Non Discretionary Trust. In the case of Shakuntala Devi, we would have suggested Discretionary Trust, by which Trustee will have the option to decide the distribution ratio amongst beneficiaries.

Another way to classify Trust is Revocable Trust and Irrevocable Trust – To get tax benefits we suggest, Irrevocable Discretionary Private Trust for “ultra high net worth” families, especially when the family tree is complex.

Image courtesy: The New York Times, Scroll Droll